For much of the past decade, Emirates operated one of the most unusual fleets in global aviation. While most long-haul airlines rely on a mix of aircraft sizes, the Dubai-based carrier built its network almost entirely around two widebody aircraft: the Airbus A380 and the Boeing 777.

The approach was deliberate. Rather than matching aircraft size to individual routes, Emirates designed its entire business model around moving large numbers of passengers through a single global hub in Dubai. The strategy helped the airline expand rapidly and establish itself as one of the world’s largest international carriers.

How Emirates’ fleet strategy developed

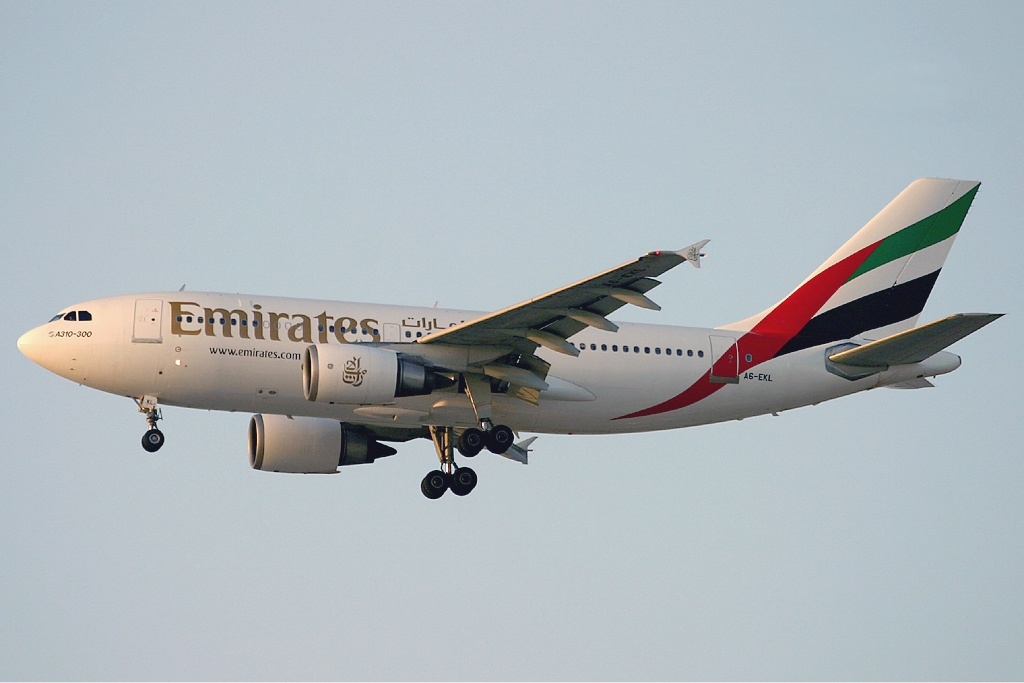

Emirates did not begin as a two-aircraft airline. When the carrier launched in 1985, it operated leased aircraft and expanded cautiously through the late 1980s and 1990s using a mixed fleet that included the Airbus A300, A310, A330, and A340 alongside early Boeing 777 variants.

During this period, the airline was still developing its identity. Like most international carriers, it operated different aircraft types for different markets and gradually expanded its long-haul network from Dubai.

The shift came in the early 2000s as Dubai positioned itself as a global transit hub. Emirates committed to a very different growth strategy by concentrating on connecting passengers onto high-capacity long-haul aircraft rather than building a short-haul feeder network.

By 2016, Emirates had effectively become a long-haul airline built around the A380 and 777, unique among major global carriers.

A network designed for widebody aircraft

Emirates’ route structure is shaped by geography. From Dubai, most major population centres in Europe, Asia, Africa, and Australia fall within a single long-haul flight.

Instead of operating many daily frequencies, the airline concentrated demand into fewer departures using larger aircraft. The Boeing 777-300ER and Airbus A380 offered the range, cargo capability, and passenger volume needed to make that model viable.

Passengers from dozens of different cities could connect through one airport onto a single onward flight. This allowed Emirates to serve routes that would not sustain non-stop flights between the cities themselves.

This approach worked, and by the late 2010s, the airline added dozens of destinations while maintaining a simple fleet structure.

Why operating only two aircraft types worked

Operating a limited fleet created efficiencies across almost every part of the airline.

Training requirements were simplified because flight crew, engineers, and cabin crew needed qualification on fewer aircraft families. Rostering also became easier, as aircraft substitutions caused minimal disruption.

Maintenance planning also benefited. Large numbers of identical aircraft allowed spare parts, tooling, and technical expertise to be centralised in Dubai. Aircraft could be reassigned across global routes without major operational adjustments.

The strategy also supported Emirates’ highly regarded brand. The airline invested heavily in its onboard product, including private suites on the Boeing 777 and the A380’s onboard shower and lounge. Passengers flying across the airline’s network could expect a similar experience. In effect, the fleet became part of the airline’s identity.

The limitations of a highly standardised fleet

Relying on a large fleet of widebody aircraft created some operational constraints.

The A380 and high-density 777-300ER are most efficient on routes with strong and predictable demand. They are less suited for secondary cities or markets where passenger volumes fluctuate seasonally. In those cases, airlines benefit from smaller long-range aircraft that can operate profitably with fewer passengers.

There is also operational exposure. When airlines depend heavily on a small number of aircraft types, technical issues, delivery delays, or supply-chain problems can affect a large portion of the schedule at once. For Emirates, the challenge was not growth; it was flexibility.

Why the A350 marks a strategic shift

The introduction of the Airbus A350-900 changes what Emirates can do with its network.

The aircraft is smaller than the A380 and lower-capacity versions of the 777, but significantly more fuel-efficient. That allows the airline to open routes where demand is strong but not high enough to support its largest aircraft. It also enables higher frequencies on existing routes rather than relying solely on capacity.

The upcoming Boeing 777X will replace older 777-300ER aircraft while maintaining Emirates’ high-capacity long-haul backbone. Together, the A350 and 777X move the airline toward a layered fleet, combining very large aircraft for trunk routes with more flexible long-range aircraft for thinner markets.

From scale to flexibility

Emirates’ two-aircraft fleet was not the result of limited options. It was a strategy tailored to Dubai’s location and a hub-and-spoke model built on transferring passengers between continents.

For nearly two decades, the combination of the Airbus A380 and Boeing 777 enabled rapid expansion, operational simplicity, and a consistent onboard product. The airline’s next phase does not replace that approach but refines it.

The addition of the A350, and eventually the 777X, signals a shift in priorities. Emirates is no longer focused solely on carrying the maximum number of passengers through its hub. Instead, it is adding the flexibility to serve more cities, adjust capacity, and operate routes that previously did not fit within its fleet structure.

The strategy that once depended on scale is now evolving towards adaptability, a natural progression as global travel patterns change and competition intensifies across long-haul markets.

Have questions or want to share your thoughts?