London Heathrow Airport is the United Kingdom’s primary gateway to the world, and one of Europe’s most important hubs. Handling 83.9 million passengers in 2024, it ranks as the busiest airport in Europe by scheduled seat capacity, with 51.5 million seats available, according to OAG. Globally, it remains one of the busiest international airports, underlining its importance to both business and leisure travel.

But beneath these impressive figures lies a growing problem: Heathrow is operating at the edge of its capacity. According to a report published by Heathrow Airport Limited in 2025, the airport is currently at 99% capacity. The dual runway configuration, limited by curfews and slot constraints, is designed to handle 480,000 flights every year (just over 1,300 per day). Terminals, originally designed for around 82 million passengers annually, are now under pressure from rising demand.

The Third Runway Debate

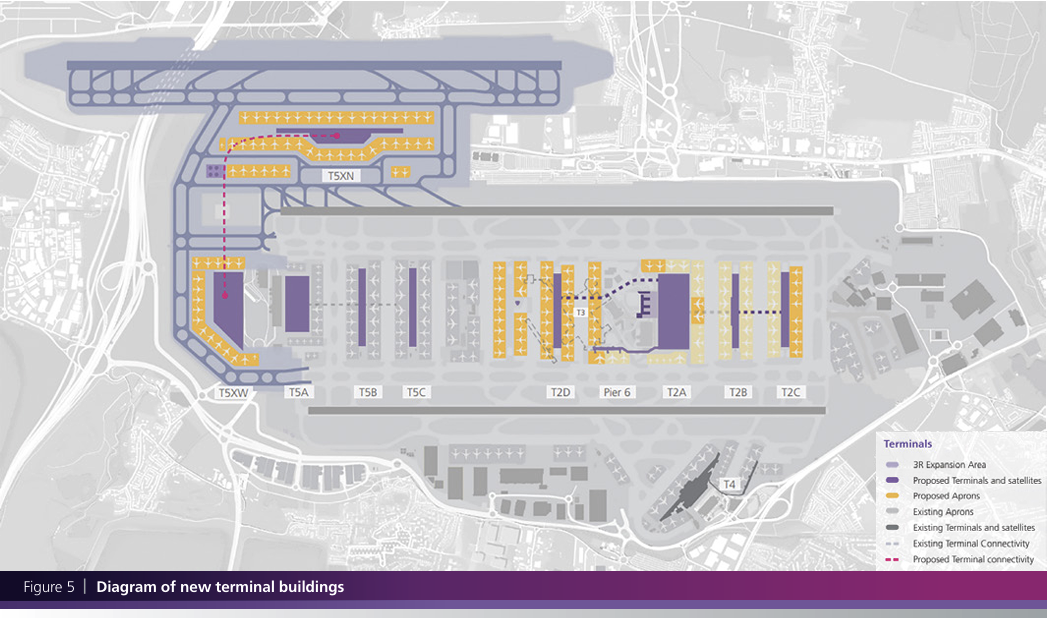

Heathrow’s expansion proposals go well beyond modest tweaks. At the heart of the plan is a third runway (the northwest runway), alongside expanded terminals, new satellite piers, and major surface access upgrades, such as road diversions and rail improvements. If delivered in full, capacity could rise from today’s 80–85 million passengers annually, to as many as 150 million. The current business airport globally is Atlanta’s Hartfield Jackson Airport with over 108 million passengers in 2024.

The total estimated cost for this build is around £49 billion, covering the new runway, terminal space, and associated infrastructure. In the nearer term, Heathrow intends to deliver incremental growth. Between 2027 and 2031, about 70,000 square metres of new terminal space and upgraded cargo facilities are planned, which could lift capacity to roughly 92 million passengers per year, even before the third runway opens.

However, the debate over a third runway is far from new, with formal debates beginning in the 1970s. Successive governments have launched reviews, inquiries, and commissions, only to see plans stall amid legal challenges, shifting political priorities, and mounting environmental opposition. Key milestones include the 2010 cancellation by the coalition government, 2018 parliamentary approval, the 2020 Court of Appeal block on climate grounds, and the 2021 Supreme Court ruling that reinstated the project. Nearly a decade after the Airports Commission recommended expansion, the runway remains unbuilt, and even in the best case scenario, it is unlikely to open before the mid 2030s.

Environmental issues remain the greatest obstacle. Expanding Heathrow would mean higher carbon emissions, increased noise pollution, and significant local disruption, including the loss of housing and green space. Campaigners argue that adding a runway is incompatible with the UK’s legally binding net zero targets. Heathrow insists that mitigation measures, quieter aircraft, and more efficient operations can balance growth with sustainability, but the debate continues to divide policymakers, industry, and communities.

Funding is another sticking point. Heathrow has proposed raising average passenger charges from £28.46, to around £33.26 per passenger in the next regulatory period, to help finance the works, raising concerns about higher ticket prices.

Transfer Traffic

Heathrow has always been a clear choice for passengers wanting to connect onto further destinations, originating from Europe, and mainly using British Airways to fly onwards to the world. However, in recent years, other major European hubs such as Amsterdam and Frankfurt have captured a greater share of connecting traffic. In 2024, 21% of Heathrow’s passengers were transferring, compared with 37% at Amsterdam, and 49% at Frankfurt.

A major constraint at Heathrow regarding transfer passengers is the separation of the terminals, making it more difficult to seamlessly transfer between them. For example, if a passenger flies into Terminal 5 with British Airways from Manchester, then onwards to Charlotte from Terminal 3 with American Airlines, they must use a dedicated transfer bus. In contrast, Amsterdam operates one large terminal, simplifying transfers. Even at Frankfurt, while there are separate terminals, they are connected in a way that makes transfer more seamless.

This structural disadvantage also affects airline alliances. Heathrow is dominated by Oneworld, particularly British Airways and American Airlines, but SkyTeam hubs like Amsterdam (KLM and Delta), and Star Alliance hubs like Frankfurt (Lufthansa, United, Singapore Airlines), offer tighter, more convenient transfers. This has helped rival airports strengthen their position as global connectors, while Heathrow has remained constrained.

Gatwick Gains From Heathrow’s Squeeze

In recent years, London Gatwick has increasingly acted as a relief hub for Heathrow’s capacity crunch. While it is known as the world’s busiest single runway airport, Gatwick still handled an impressive 43.24 million passengers in 2024. It has attracted a growing list of long-haul carriers looking for London access, without the steep competition for slots at Heathrow. Airlines such as Qatar Airways, Gulf Air, Air Mauritius, Saudia, Singapore Airlines, Kenya Airways, and Ethiopian Airlines, all now operate from Gatwick.

For some airlines, the move is strategic. Gatwick offers lower operating costs, quicker turnaround times, and access to a different passenger catchment area in London and the South East. For others, it is necessity. With Heathrow slots virtually impossible to secure, or prohibitively expensive, Gatwick provides the only viable gateway into the London market.

Economics also play a role. According to the UK Civil Aviation Authority, passengers at Heathrow pay what has been described as a congestion premium. Long haul return fares carry a 15–23% price premium, compared to other London airports, equating to an extra £90–£160 per ticket. With Heathrow already allowed to charge airlines an average of £30 per passenger, costs are rising for both carriers and travellers. Gatwick, by contrast, offers a more affordable alternative, helping airlines maintain competitive pricing.

The airport has also benefitted from British Airways and easyJet building significant operations there, creating onward connectivity. As a result, Gatwick has grown beyond being simply an overspill option, positioning itself as an alternative long-haul gateway in its own right.

Heathrow’s status as the UK’s global hub is both its greatest strength, and its greatest challenge. Without expansion, it risks falling behind rival European airports in transfer traffic and capacity. With expansion, it faces decades old battles over cost, environmental impact, and political approval.

In the meantime, Gatwick is quietly carving out a larger role, attracting long haul carriers and handling tens of millions of passengers each year. Together, the two airports illustrate the unique dynamics of London’s multi airport system, one constrained by its dominance, the other thriving in its shadow.

Have questions or want to share your thoughts?

.jpg)