REPORT: Perth could become major Qantas gateway to Europe.

07 June, 2020

9 min read

By joining our newsletter, you agree to our Privacy Policy

According to a new report, Perth could become a major Qantas gateway to Europe. Below we publish the report by Linus Benjamin Bauer and Daniel Bloch in full.

Blue Ocean Strategy in the Post-COVID19 Era

Authors: - Linus Benjamin Bauer (Managing Consultant at Bauer Aviation Advisory and Visiting Lecturer in Air Transport Management at the City University of London) - Daniel Bloch (Principal at Bloch Aviation Advisory, IE University)

The implications of COVID-19 has sent shockwaves throughout the aviation industry, sending a myriad of liquidity-strapped airlines across the globe into administration or partial government ownership (Bauer, Bloch and Merkert, 2020). Perhaps most indicative of this, global flight capacity has been slashed by up to 90 percent. To this end, the International Air Transport Association (IATA) has recently released a new set of revised figures that predicts as a direct result of the Coronavirus, the sector will be forced to incur losses between US$248bn – US$260bn.

In turn, the inherent uncertainty levels that are synonymous with current times has left a wide array of airlines struggling to navigate uncharted territories. As a result, there is an urgent and existential call for action across the entire value chain of the sector, of which must be founded on the basis of strategic creativity; prioritizing human health factors, sustainability and profitability all in tandem.

In light of this, various clients, executives, industry professionals, and trade journalists have come forward with the following questions:

How do we collectively create demand during a recovery phase, rather than fighting over what exists? How and why might genuine cost leaders or differentiators be able to cope better with that challenging situation? Are there new ways of thinking or approaches in existence that could upend traditional thinking about aviation strategy? What are the core requirements for strategic success in the post-COVID-19 era? What kind of emerging business models, with blue ocean potential, could be accelerated by COVID-19?

Let’s try to shed some light on these questions…

Most strategists at airlines around the world will agree that business is all about making hard decisions, in the midst of crucial and often binary tradeoffs, that hold vastly different pathways ahead. The economist and business strategist Michael Porter breaks down the choices that companies must make by claiming that successful firms will either take up a position of price leadership (e.g. Low-Cost Carriers) or product differentiators (e.g. Full-Service Network Carriers). As such, those who fail to identify themselves within one of either bracket often encounter difficulties in ascertaining a competitive advantage, which only becomes further accentuated in a time of crisis.

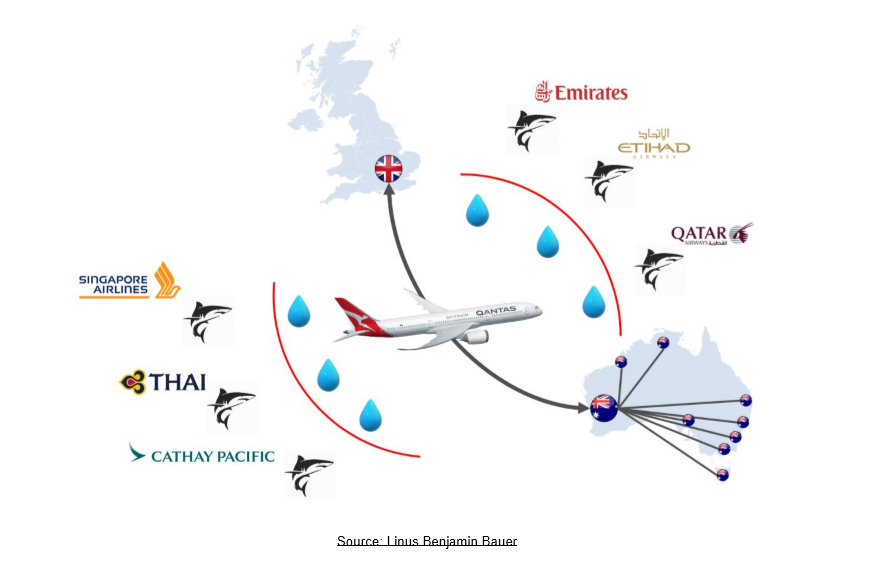

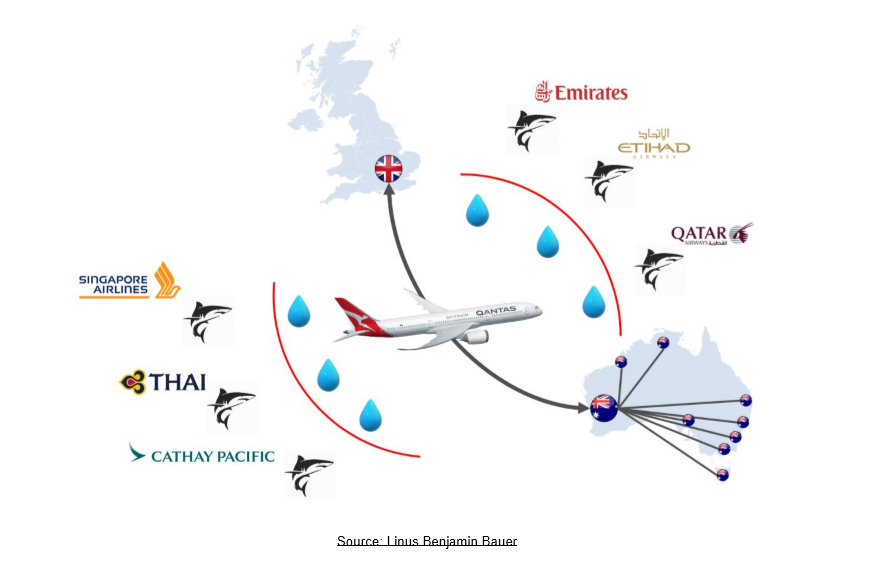

On the one hand, this theory provides a strong theoretical foundation to assess the nature of airline business models and how they would respectively go about re-emerging post the COVID-19 pandemic. However, it fails to recognize the volatility and imbalances at present between international markets, such that some regions of the globe will be slower to open up than others, thereby generating a set of arbitrary ‘winners’ and ‘losers’ of which can largely only be attributed to luck. To this effect, it would allow specific airlines to operate approved flights once again, before the rest of the competition. For example, an airline such as Qantas, with the strong future prospect of an Australia-UK travel bubble opening-up, could look to lay claim over the UK-Australia market from either a price-leadership or product differentiation standpoint. This is on the basis that Qantas’ competitors, of who typically operate one-stop itineraries between Australia and Europe, would not be able to return to services as quickly as the Australian national carrier. Due to the highly competitive market along the Kangaroo Route (Australia-UK), within which Qantas competes with Hub and Spoke carriers such as Emirates and Singapore Airlines, the market context can be considered as a red ocean. Historically in terms of market share, a small group of ‘sharks’, namely the Gulf State Carriers (EK, QR, EY) have dominated the market, with the remaining competitors across Australia, Asia and the UK classified as ‘bait.’ However, in recent years, Qantas’ has sought to differentiate its service by providing direct, Ultra Long-Haul operations between Perth and London. In turn, this new-age approach has to-date delivered the national carrier significantly strong returns, thereby proving the premise that there is indeed a market for a differentiated, long-range, point-to-point product.

Source: Linus Benjamin Bauer

In turn, looking deeper into this prospect there is significant scope to suggest that the COVID19 crisis has provided the foundations for a range of blue ocean opportunities to existing Ultra Long-Haul operators, such as Qantas. To this end, Ultra Long-Haul could become an emerging business model for FSNCs in the post-COVID-19 era, on the basis and condition of the following factors:

The operating airline maintains access to a strong domestic feeder system An expected increase in demand for direct services (+ domestic feeder flight) in the next 24-36 months takes place. Fast-changing customer behavior sees stronger prioritization of health, security and sanitization factors, of which Ultra Long-Haul services provide significant benefits Among travelers, there will be a greater willingness-to-pay for direct services, especially among business and VFR travelers with strong needs and motivation to travel Generation of higher Seat-Load Factors and Yields, supported by efficient, twin-engine, long-range aircraft with moderate cabin density and heavy premium configurations - e.g. Boeing 787-9 / Airbus A350-900ULR Point-to-Point Ultra Long-Haul affords the operating airline with a heightened level of network flexibility, vis-à-vis Hub & Spoke operations, with the agile ability to adapt O&Ds based on peaks and troughs in demand, as well as any regional re-emergences of the virus in specific parts of the world. Ultra Long-Haul affords passengers with the unique health advantage of being able to avoid connecting through a densely populated hub airport Ultra Long-Haul avoids the heightened complexity associated with connecting at large hub airports, which otherwise entails an increase in costs, a higher risk of operational setbacks and delays, as well as minimizing the need for 2 take-offs and landings on one itinerary.

All these above-mentioned factors contribute to the creation of new, additional demand for direct services between Australia and Europe in the near future. With this in mind, in such a blue ocean context, airlines can create demand rather than fight over what exists. In this case, Qantas could create new demand by launching additional Ultra Long-Haul services between Perth and other European cities (e.g. Paris, Frankfurt and Manchester) in addition to the existing service to London. Moreover, a double-daily Perth-London service (e.g. SYD-PERLHR, in addition to the existing MEL-PER-LHR) could also become a viable option in the foreseeable future.

In the pursuit of sustained and profitable growth, airlines tend to engage in head-to-head competition. Yet in the airline industry, of which has faced crippling overcapacity issues prior to the COVID-19 outbreak, head-on competition has largely only resulted in fierce red ocean rivalries, with a shrinking pool of profit being fought over until the end. Rather what must be considered, now more than ever, is that the establishment of lasting success more often will come from the creation blue oceans, in which untapped, underserved, or changing market spaces are explored in full.

Importantly, in a Post COVID-19 context, a Blue Ocean Strategy will not only need to pursue a new angle to product differentiation or price leadership for a given market, but it must also do say in a way that instills confidence back into the base of airline passengers and stakeholders alike. Simply stated, a failure to do so will compromise any new venture’s ability to succeed in a post-pandemic era.

To this end, the airline industry must recognize that over the past years, it has been competing itself to death. On the one hand, fares plummeted to unsustainably cheap levels, both from a financial and environmental point of view, with the quality of product and service declining in turn. Whilst effective for a portion of the market, this increasingly overbearing approach was not attractive to other customer segments, of whom longed for access to better products. Several airlines fell victim to simply following the herd in this regard; however, there have been exceptions. For example, Qantas through its Ultra Long-Haul approach has sought out an uncontested niche market that captures a whole new demographic of additional customers

(VFR and leisure travelers) that had traditionally not previously flown on premium airlines. Qantas re-tweaked its Hard and Soft Products, eliminating features deemed unnecessary such as onboard duty-free sales, thereby reducing weight and costs, whilst simultaneously including new value-added features such as a wellbeing program, a critiqued menu promoting hydration and rest, and a state-of-the-art transit lounge in Perth dedicated to the Ultra Long-Haul service. In turn, Qantas has focused on attracting a segment of premium customers who typically fly between Europe and Australia with a degree of frequency, of whom are open to paying a premium fare of around 30%, for higher quality and more efficient service.

Key takeaways:

Across the aviation sector, the COVID-19 outbreak has generated an unprecedented need for the industry to pursue, find, and explore Blue Ocean Strategies. The rising influence of social media and global interconnections has created a wave of newly communicated priorities among the global community, of which health and safety have become central. Airlines in turn must respond accordingly. A locational shift in future demand and growth, both during and after the COVID-19 recovery phase (Q3/2020 – 2023/2024), is to be expected. Competition should not occupy the center of post-COVID-19 strategic thinking. The current industry structure is not a given; it can be shaped by airlines Strategic creativity can be unlocked systematically. Efficient and effective project execution begins with clear strategy formulation. Need for developing step-by-step and contingency modeling for airline strategy.

Source: Linus Benjamin Bauer

In turn, looking deeper into this prospect there is significant scope to suggest that the COVID19 crisis has provided the foundations for a range of blue ocean opportunities to existing Ultra Long-Haul operators, such as Qantas. To this end, Ultra Long-Haul could become an emerging business model for FSNCs in the post-COVID-19 era, on the basis and condition of the following factors:

The operating airline maintains access to a strong domestic feeder system An expected increase in demand for direct services (+ domestic feeder flight) in the next 24-36 months takes place. Fast-changing customer behavior sees stronger prioritization of health, security and sanitization factors, of which Ultra Long-Haul services provide significant benefits Among travelers, there will be a greater willingness-to-pay for direct services, especially among business and VFR travelers with strong needs and motivation to travel Generation of higher Seat-Load Factors and Yields, supported by efficient, twin-engine, long-range aircraft with moderate cabin density and heavy premium configurations - e.g. Boeing 787-9 / Airbus A350-900ULR Point-to-Point Ultra Long-Haul affords the operating airline with a heightened level of network flexibility, vis-à-vis Hub & Spoke operations, with the agile ability to adapt O&Ds based on peaks and troughs in demand, as well as any regional re-emergences of the virus in specific parts of the world. Ultra Long-Haul affords passengers with the unique health advantage of being able to avoid connecting through a densely populated hub airport Ultra Long-Haul avoids the heightened complexity associated with connecting at large hub airports, which otherwise entails an increase in costs, a higher risk of operational setbacks and delays, as well as minimizing the need for 2 take-offs and landings on one itinerary.

All these above-mentioned factors contribute to the creation of new, additional demand for direct services between Australia and Europe in the near future. With this in mind, in such a blue ocean context, airlines can create demand rather than fight over what exists. In this case, Qantas could create new demand by launching additional Ultra Long-Haul services between Perth and other European cities (e.g. Paris, Frankfurt and Manchester) in addition to the existing service to London. Moreover, a double-daily Perth-London service (e.g. SYD-PERLHR, in addition to the existing MEL-PER-LHR) could also become a viable option in the foreseeable future.

In the pursuit of sustained and profitable growth, airlines tend to engage in head-to-head competition. Yet in the airline industry, of which has faced crippling overcapacity issues prior to the COVID-19 outbreak, head-on competition has largely only resulted in fierce red ocean rivalries, with a shrinking pool of profit being fought over until the end. Rather what must be considered, now more than ever, is that the establishment of lasting success more often will come from the creation blue oceans, in which untapped, underserved, or changing market spaces are explored in full.

Importantly, in a Post COVID-19 context, a Blue Ocean Strategy will not only need to pursue a new angle to product differentiation or price leadership for a given market, but it must also do say in a way that instills confidence back into the base of airline passengers and stakeholders alike. Simply stated, a failure to do so will compromise any new venture’s ability to succeed in a post-pandemic era.

To this end, the airline industry must recognize that over the past years, it has been competing itself to death. On the one hand, fares plummeted to unsustainably cheap levels, both from a financial and environmental point of view, with the quality of product and service declining in turn. Whilst effective for a portion of the market, this increasingly overbearing approach was not attractive to other customer segments, of whom longed for access to better products. Several airlines fell victim to simply following the herd in this regard; however, there have been exceptions. For example, Qantas through its Ultra Long-Haul approach has sought out an uncontested niche market that captures a whole new demographic of additional customers

(VFR and leisure travelers) that had traditionally not previously flown on premium airlines. Qantas re-tweaked its Hard and Soft Products, eliminating features deemed unnecessary such as onboard duty-free sales, thereby reducing weight and costs, whilst simultaneously including new value-added features such as a wellbeing program, a critiqued menu promoting hydration and rest, and a state-of-the-art transit lounge in Perth dedicated to the Ultra Long-Haul service. In turn, Qantas has focused on attracting a segment of premium customers who typically fly between Europe and Australia with a degree of frequency, of whom are open to paying a premium fare of around 30%, for higher quality and more efficient service.

Key takeaways:

Across the aviation sector, the COVID-19 outbreak has generated an unprecedented need for the industry to pursue, find, and explore Blue Ocean Strategies. The rising influence of social media and global interconnections has created a wave of newly communicated priorities among the global community, of which health and safety have become central. Airlines in turn must respond accordingly. A locational shift in future demand and growth, both during and after the COVID-19 recovery phase (Q3/2020 – 2023/2024), is to be expected. Competition should not occupy the center of post-COVID-19 strategic thinking. The current industry structure is not a given; it can be shaped by airlines Strategic creativity can be unlocked systematically. Efficient and effective project execution begins with clear strategy formulation. Need for developing step-by-step and contingency modeling for airline strategy.

Source: Linus Benjamin Bauer

In turn, looking deeper into this prospect there is significant scope to suggest that the COVID19 crisis has provided the foundations for a range of blue ocean opportunities to existing Ultra Long-Haul operators, such as Qantas. To this end, Ultra Long-Haul could become an emerging business model for FSNCs in the post-COVID-19 era, on the basis and condition of the following factors:

The operating airline maintains access to a strong domestic feeder system An expected increase in demand for direct services (+ domestic feeder flight) in the next 24-36 months takes place. Fast-changing customer behavior sees stronger prioritization of health, security and sanitization factors, of which Ultra Long-Haul services provide significant benefits Among travelers, there will be a greater willingness-to-pay for direct services, especially among business and VFR travelers with strong needs and motivation to travel Generation of higher Seat-Load Factors and Yields, supported by efficient, twin-engine, long-range aircraft with moderate cabin density and heavy premium configurations - e.g. Boeing 787-9 / Airbus A350-900ULR Point-to-Point Ultra Long-Haul affords the operating airline with a heightened level of network flexibility, vis-à-vis Hub & Spoke operations, with the agile ability to adapt O&Ds based on peaks and troughs in demand, as well as any regional re-emergences of the virus in specific parts of the world. Ultra Long-Haul affords passengers with the unique health advantage of being able to avoid connecting through a densely populated hub airport Ultra Long-Haul avoids the heightened complexity associated with connecting at large hub airports, which otherwise entails an increase in costs, a higher risk of operational setbacks and delays, as well as minimizing the need for 2 take-offs and landings on one itinerary.

All these above-mentioned factors contribute to the creation of new, additional demand for direct services between Australia and Europe in the near future. With this in mind, in such a blue ocean context, airlines can create demand rather than fight over what exists. In this case, Qantas could create new demand by launching additional Ultra Long-Haul services between Perth and other European cities (e.g. Paris, Frankfurt and Manchester) in addition to the existing service to London. Moreover, a double-daily Perth-London service (e.g. SYD-PERLHR, in addition to the existing MEL-PER-LHR) could also become a viable option in the foreseeable future.

In the pursuit of sustained and profitable growth, airlines tend to engage in head-to-head competition. Yet in the airline industry, of which has faced crippling overcapacity issues prior to the COVID-19 outbreak, head-on competition has largely only resulted in fierce red ocean rivalries, with a shrinking pool of profit being fought over until the end. Rather what must be considered, now more than ever, is that the establishment of lasting success more often will come from the creation blue oceans, in which untapped, underserved, or changing market spaces are explored in full.

Importantly, in a Post COVID-19 context, a Blue Ocean Strategy will not only need to pursue a new angle to product differentiation or price leadership for a given market, but it must also do say in a way that instills confidence back into the base of airline passengers and stakeholders alike. Simply stated, a failure to do so will compromise any new venture’s ability to succeed in a post-pandemic era.

To this end, the airline industry must recognize that over the past years, it has been competing itself to death. On the one hand, fares plummeted to unsustainably cheap levels, both from a financial and environmental point of view, with the quality of product and service declining in turn. Whilst effective for a portion of the market, this increasingly overbearing approach was not attractive to other customer segments, of whom longed for access to better products. Several airlines fell victim to simply following the herd in this regard; however, there have been exceptions. For example, Qantas through its Ultra Long-Haul approach has sought out an uncontested niche market that captures a whole new demographic of additional customers

(VFR and leisure travelers) that had traditionally not previously flown on premium airlines. Qantas re-tweaked its Hard and Soft Products, eliminating features deemed unnecessary such as onboard duty-free sales, thereby reducing weight and costs, whilst simultaneously including new value-added features such as a wellbeing program, a critiqued menu promoting hydration and rest, and a state-of-the-art transit lounge in Perth dedicated to the Ultra Long-Haul service. In turn, Qantas has focused on attracting a segment of premium customers who typically fly between Europe and Australia with a degree of frequency, of whom are open to paying a premium fare of around 30%, for higher quality and more efficient service.

Key takeaways:

Across the aviation sector, the COVID-19 outbreak has generated an unprecedented need for the industry to pursue, find, and explore Blue Ocean Strategies. The rising influence of social media and global interconnections has created a wave of newly communicated priorities among the global community, of which health and safety have become central. Airlines in turn must respond accordingly. A locational shift in future demand and growth, both during and after the COVID-19 recovery phase (Q3/2020 – 2023/2024), is to be expected. Competition should not occupy the center of post-COVID-19 strategic thinking. The current industry structure is not a given; it can be shaped by airlines Strategic creativity can be unlocked systematically. Efficient and effective project execution begins with clear strategy formulation. Need for developing step-by-step and contingency modeling for airline strategy.

Source: Linus Benjamin Bauer

In turn, looking deeper into this prospect there is significant scope to suggest that the COVID19 crisis has provided the foundations for a range of blue ocean opportunities to existing Ultra Long-Haul operators, such as Qantas. To this end, Ultra Long-Haul could become an emerging business model for FSNCs in the post-COVID-19 era, on the basis and condition of the following factors:

The operating airline maintains access to a strong domestic feeder system An expected increase in demand for direct services (+ domestic feeder flight) in the next 24-36 months takes place. Fast-changing customer behavior sees stronger prioritization of health, security and sanitization factors, of which Ultra Long-Haul services provide significant benefits Among travelers, there will be a greater willingness-to-pay for direct services, especially among business and VFR travelers with strong needs and motivation to travel Generation of higher Seat-Load Factors and Yields, supported by efficient, twin-engine, long-range aircraft with moderate cabin density and heavy premium configurations - e.g. Boeing 787-9 / Airbus A350-900ULR Point-to-Point Ultra Long-Haul affords the operating airline with a heightened level of network flexibility, vis-à-vis Hub & Spoke operations, with the agile ability to adapt O&Ds based on peaks and troughs in demand, as well as any regional re-emergences of the virus in specific parts of the world. Ultra Long-Haul affords passengers with the unique health advantage of being able to avoid connecting through a densely populated hub airport Ultra Long-Haul avoids the heightened complexity associated with connecting at large hub airports, which otherwise entails an increase in costs, a higher risk of operational setbacks and delays, as well as minimizing the need for 2 take-offs and landings on one itinerary.

All these above-mentioned factors contribute to the creation of new, additional demand for direct services between Australia and Europe in the near future. With this in mind, in such a blue ocean context, airlines can create demand rather than fight over what exists. In this case, Qantas could create new demand by launching additional Ultra Long-Haul services between Perth and other European cities (e.g. Paris, Frankfurt and Manchester) in addition to the existing service to London. Moreover, a double-daily Perth-London service (e.g. SYD-PERLHR, in addition to the existing MEL-PER-LHR) could also become a viable option in the foreseeable future.

In the pursuit of sustained and profitable growth, airlines tend to engage in head-to-head competition. Yet in the airline industry, of which has faced crippling overcapacity issues prior to the COVID-19 outbreak, head-on competition has largely only resulted in fierce red ocean rivalries, with a shrinking pool of profit being fought over until the end. Rather what must be considered, now more than ever, is that the establishment of lasting success more often will come from the creation blue oceans, in which untapped, underserved, or changing market spaces are explored in full.

Importantly, in a Post COVID-19 context, a Blue Ocean Strategy will not only need to pursue a new angle to product differentiation or price leadership for a given market, but it must also do say in a way that instills confidence back into the base of airline passengers and stakeholders alike. Simply stated, a failure to do so will compromise any new venture’s ability to succeed in a post-pandemic era.

To this end, the airline industry must recognize that over the past years, it has been competing itself to death. On the one hand, fares plummeted to unsustainably cheap levels, both from a financial and environmental point of view, with the quality of product and service declining in turn. Whilst effective for a portion of the market, this increasingly overbearing approach was not attractive to other customer segments, of whom longed for access to better products. Several airlines fell victim to simply following the herd in this regard; however, there have been exceptions. For example, Qantas through its Ultra Long-Haul approach has sought out an uncontested niche market that captures a whole new demographic of additional customers

(VFR and leisure travelers) that had traditionally not previously flown on premium airlines. Qantas re-tweaked its Hard and Soft Products, eliminating features deemed unnecessary such as onboard duty-free sales, thereby reducing weight and costs, whilst simultaneously including new value-added features such as a wellbeing program, a critiqued menu promoting hydration and rest, and a state-of-the-art transit lounge in Perth dedicated to the Ultra Long-Haul service. In turn, Qantas has focused on attracting a segment of premium customers who typically fly between Europe and Australia with a degree of frequency, of whom are open to paying a premium fare of around 30%, for higher quality and more efficient service.

Key takeaways:

Across the aviation sector, the COVID-19 outbreak has generated an unprecedented need for the industry to pursue, find, and explore Blue Ocean Strategies. The rising influence of social media and global interconnections has created a wave of newly communicated priorities among the global community, of which health and safety have become central. Airlines in turn must respond accordingly. A locational shift in future demand and growth, both during and after the COVID-19 recovery phase (Q3/2020 – 2023/2024), is to be expected. Competition should not occupy the center of post-COVID-19 strategic thinking. The current industry structure is not a given; it can be shaped by airlines Strategic creativity can be unlocked systematically. Efficient and effective project execution begins with clear strategy formulation. Need for developing step-by-step and contingency modeling for airline strategy.Get the latest news and updates straight to your inbox

No spam, no hassle, no fuss, just airline news direct to you.

By joining our newsletter, you agree to our Privacy Policy

Find us on social media

Comments

No comments yet, be the first to write one.