Boeing picking up speed but significant challenges remain

07 May, 2021

3 min read

By joining our newsletter, you agree to our Privacy Policy

Boeing is gaining speed on the runway to recovery with the company forecasting commercial sales more than double those of 2020 but it faces headwinds from arch-rival Airbus’s best selling A320 family.

Airbus is now king of the commercial market with double the backlog of Boeing led by the record selling 180-230 seat A320 family (A320) which is perfectly positioned for the post-COVID-19 world of lesser demand and shorter routes.

The A320 has outsold its Boeing rival, the 180-220 seat 737 family, for some years, and its top-end model the A321 has more capacity and range making them ideal to replace bigger aircraft in tough times.

And the A320, which is marginally wider than the 737 now sports a space-age interior that is more attractive to passengers.

Airbus has a backlog of 5,701 A320 aircraft while Boeing has 3,240 737 MAX aircraft to deliver.

This year, Boeing expects commercial aircraft revenues of US$38.9 billion compared to just US$16 billion in 2020 but half that of 2018’s record of $US60.7 billion.

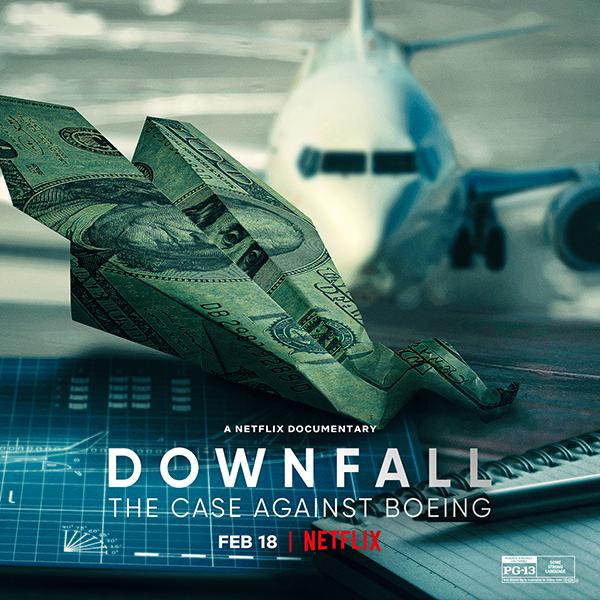

Boeing’s 737 MAX has been grounded for two years over two tragic software-related crashes and deliveries only resumed late last year after a series of fixes were ticked off by regulators.

In the first quarter of 2021 Boeing delivered 58 737 MAXs to airlines and also resumed deliveries of its 250-350 seat 787 after some production quality issues.

New York analyst Bernstein says that it expects Boeing to deliver 370 737s this year with over 600 next year.

Based on those deliveries Bernstein has upgraded Boeing from under-perform at US$196 to Market-perform at $229.

In March 2019, Boeing stock was at the giddy heights of $US440 but a year later as COVID-19 hit the stock spiraled to US$99.

Bernstein warns however that it is still a complicated market recovery for aircraft manufacturers.

It says that while the US domestic market is recovering more quickly than many expected and China domestic capacity came back in later 2020 the EU recovery has been very weak with international traffic in Asia and elsewhere even in worse shape.

That gloomy outlook for international is a challenge for Boeing as its new twin-engine 777X is designed for long-range high capacity to replace 747s and A380s.

Originally the 777X was to enter service in late 2019 but engine issues and then COVID-19 has delayed it till late 2023.

Those problems forced Boeing to take a US$6.5 billion forward loss on the program.

Supporting the commercial side of the business is Boeing’s strength in military and space with a sales forecast for 2021 of $US28 billion and global Services of $US13.9 billion.

The biggest challenge for Boeing is launching a new aircraft to compete with the Airbus A321XLR the most potent of the A320 family.

Before the two MAX crashes in late 2018 and early 2019 Boeing was close to launching its 797 a twin-aisle 250 -270 seat aircraft with a range of 10 hours.

But financial constraints on airlines and Boeing may mean a more modest single-aisle design emerges.

Get the latest news and updates straight to your inbox

No spam, no hassle, no fuss, just airline news direct to you.

By joining our newsletter, you agree to our Privacy Policy

Find us on social media

Comments

No comments yet, be the first to write one.