What Is Next From Boeing?

22 May, 2023

8 min read

By joining our newsletter, you agree to our Privacy Policy

What is next from Boeing - that is the question being asked after the company's CEO and chairman David Calhoun erased any idea, or dreams, that the aerospace giant would launch the development of a new commercial aircraft in this decade during the company’s 2022 Investor Conference last November.

JOIN: AirlineRatings.com YouTube Channel

GET: Accurate MH370 Information From AirlineRatings.com Newsletter

How could this possibly be?

The world’s preeminent and largest supplier of commercial jets for the last 60 years was walking away from a new design. Not possible, surely?

Mr Calhoun was responding to the immediate demand of launching a competitor to Airbus’s hot-selling A321XLR which has a 3000km range and a few seat rows advantage over the 737 MAX.

While that is a narrow market, blue chip airlines such as Qantas swapped to the A320 family from the 737 because of the attraction of the A321XLR.

At the time Calhoun said “I don't want to fill a gap in a product line. I want to build a product that's going to differentiate in a way that absolutely substitutes the airplanes that came before it and that number has to be at least 20, 25, maybe 30 per cent better than airplanes it replaces. And there are technologies and concepts that go with that and underlying ways of building it that can get you to that answer. And they all take time and they all have to be proven.”

Calhoun’s immediate focus of course is the clear and present challenges of getting the 737MAX 10, MAX 7 and 777X certified as well as stabilizing the 787 program. While not quite having the capability of the latest A320 models the 737 MAX is nonetheless a very capable aircraft and large orders are flowing.

Other near-term challenges are supply chain disruptions but Calhoun hopes that the 737 rate can lift from 31 to 50 a month by 2025 and 787 10 a month.

According to a new report New York-based analysts Bernstein, the supply chain issues appear to be improving notwithstanding the new quality issue with some of the bolts that affix the aircraft’s tail that will slow deliveries.

Bernstein quotes Boeing's CEO of BCA (Boeing Commercial Airplanes), Stan Deal saying that 737MAX production should increase "very soon" with Bloomberg saying that the rate will lift to 38 a month mid-year.

Bernstein forecasts a 737 MAX rate of 57/month in 2026 and 63/month in 2027, “given the scale of demand.”

It adds that “with planned narrowbody rate of 50/month in 2025 or 2026, with 4,224 737 MAX in backlog, that is seven years of production at that future higher rate. For the 787, production is supposed to move to 10/month in 2025/26. Even at that higher rate, the 574-airplane backlog is nearly five years of production.”

So not having a direct competitor to the A321XLR is not a major issue.

One ace Boeing does hold is its 777X – albeit a delayed ace.

Bernstein notes that “although it has been substantially delayed, the schedule for the 777X entry into service appears to have stabilized and the GE9X engine issues appear to have been addressed.

In a recent interview with Aviation Week, EASA’s Executive Director, Patrick Ky, confirmed that significant progress has been made in the discussions surrounding the certification of the 777X

At issue is the FAA’s approach to how you deal with common mode failures versus EASA’s.

According to Aviation Week’s Guy Norris the major disagreement centres around the 777X flight control system's susceptibility to potential common mode setbacks with EASA arguing that Boeing's fly-by-wire system which could withstand at least two failures, lacked adequate protection. Instead, it favoured the Airbus approach of five distinct computers running four different software packages.

Insiders at Boeing tell AirlineRatings.com that the company has offered up more differences which it believes will pave the way for a solution.

Ky also highlighted that the 777X's folding wingtips and GE9X engines were also been securitized.

So, five months on from Calhoun’s no new plane pronouncement, Boeing has won orders and options for 1244 jets with almost 400 being for 787, production has stabilised, quality issues are almost in the rear-view mirror and certification issues appear to be resolved.

And in January Boeing snared a contract from NASA for what could be its all-new aircraft, the Transonic Truss-Braced Wing (TTBW) demonstrator aircraft.

The technologies to be demonstrated and tested as part of the Sustainable Flight Demonstrator (SFD) program will inform future designs and could lead to breakthrough aerodynamics and fuel efficiency gains.

Boeing claims that when combined with expected advancements in propulsion systems, materials and systems architecture, a single-aisle aircraft with a TTBW configuration could reduce fuel consumption and emissions up to 30 per cent relative to today’s most efficient single-aisle aircraft, depending on the mission and that is the sort of gain that prompts billions of investment dollars.

The SFD program aims to advance the civil aviation industry’s commitment to reaching net zero carbon emissions by 2050, as well as the goals set forth in the White House’s U.S. Aviation Climate Action Plan.

At the time of the announcement Greg Hyslop, Boeing‘s chief engineer and executive vice president of Engineering, Test & Technology said that “the SFD program has the potential to make a major contribution toward a sustainable future and it represents an opportunity to design, build and fly a full-scale experimental plane, while solving novel technical problems.”

NASA’s funding through the SFD Space Act Agreement totals US$425 million and the program will also leverage up to US$725 million in funding by Boeing and its industry partners to shape the demonstrator program and meet the resource needs required.

The program is not new with Boeing having spent the last decade working on the concept under NASA’s Environmentally Responsible Aviation program.

A yearlong flight-test campaign is planned to begin at NASA Armstrong Flight Research Centre, California, in 2028.

Two models are planned the 130-160 seat VS-1 and 180-210 seat VS-2 based on the MD-90 fuselage.

The TTBW is a long way from the aircraft Boeing was gearing up to launch in 2019 – the 797 – a twin-aisle 228-267 seat replacement for the 757 and lower end of the 767 market.

In late 2019 analysts were forecasting a launch of what was then termed the New Midsize Aircraft (NMA or 797), although there was a qualification that the MAX issues had to be addressed first.

Delta Air Lines CEO Ed Bastian told Bloomberg that his airline wanted 200 of the 797s to replace its 757 and 767s.

Qantas CEO Alan Joyce said, “Boeing would be mad not to launch the 797.”

The massive appeal of the 797s was to be its passenger cross-section of 2-3-2 with huge overhead luggage bins which would end the economy crush.

Boeing defined two versions – the NMA-6 (797-6) with 228-passenger, 4,500nm (8,300km) and the NMA-7 (797-7) which would seat 267 in two classes with 4,200nm range.

The company saw a market of about 5,000 planes over 20 years. But others suggest upwards of 7,000 with the potential for the aircraft to make 30,000 city pairs viable.

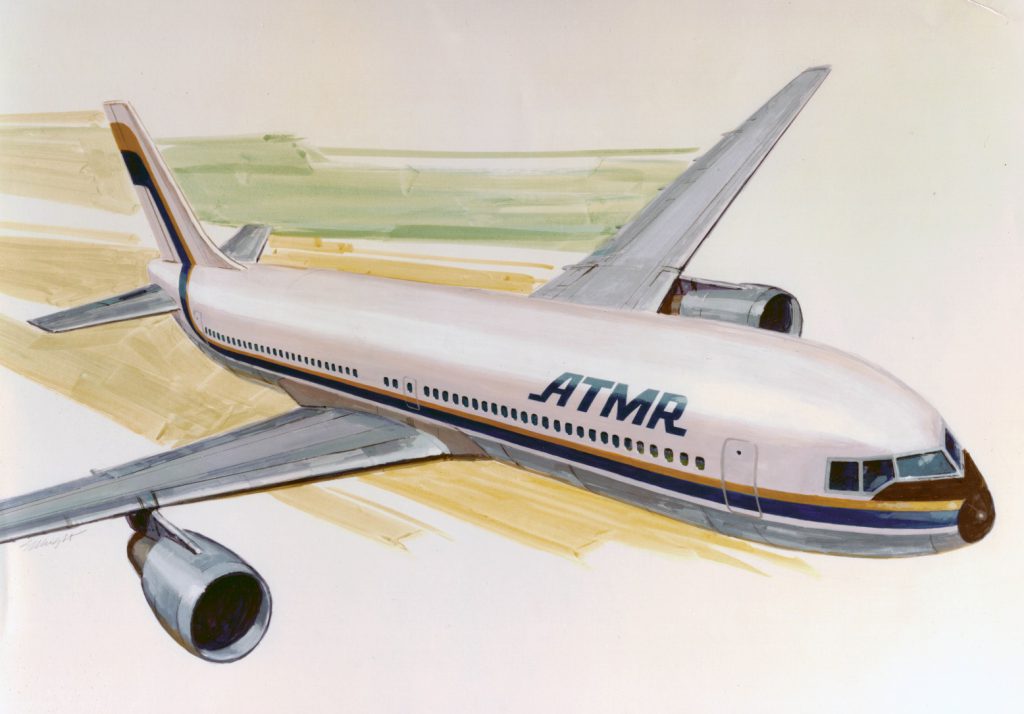

Boeing and its legacy company, McDonnell Douglas, both touted a similarly sized aircraft – 7J7 and ATMR – as early as 1980.

However, at the time aircraft seating was more spacious and passenger carry-on was very limited and airlines couldn’t make the business case.

Today passenger seating is more cramped and the demand for overhead space is far greater than a typical single-aisle allows.

The post-COVID reality however is the economy, the environment and production stability and quality.

With the 737 MAX 7, MAX 10 and 777X to be certified with significant rework for the latter and when you add the ramp-up in production the aerospace giant has significant engineering challenges for the next few years.

Perhaps when the 777X enters service in 2025 it might be time to sharpen the focus on the next big thing from Boeing.

Next Article

Qantas triples profit but misses mark

Get the latest news and updates straight to your inbox

No spam, no hassle, no fuss, just airline news direct to you.

By joining our newsletter, you agree to our Privacy Policy

Find us on social media

Comments

No comments yet, be the first to write one.