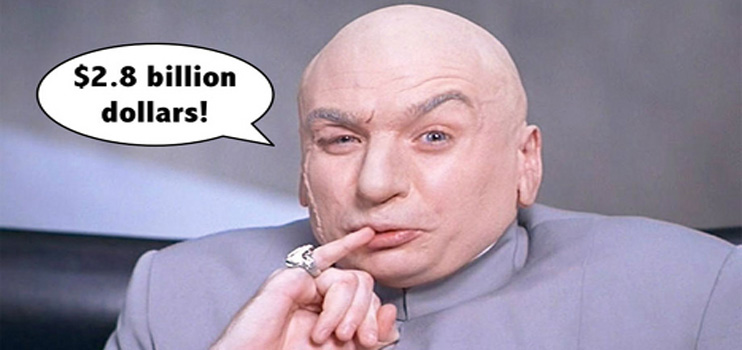

OPINION | Two point eight billion dollars. The sheer size of Qantas’ reported loss is a number so large that it bears repeating, slowly. Two point eight billion dollars.

It’s a jaw-droppingly big number. It’s quite possibly the largest loss ever posted by any airline airline anywhere in the world. And a seemingly bottomless black hole for an airline which only three years ago declared an annual profit of $552 million.

But $2.8 billion is not the number that should be taken away from the airline’s recap of the 2013-2014 financial year.

Yes, $2.8 billion was the Big Scary Number featured in every headline, the opener of every news bulletin and the start of every conversation yesterday about Qantas and by extension the performance and fate of CEO Alan Joyce, a man who probably feels like Australia’s favourite punching bag.

But most of that number, and therefore most of the loss, isn’t real.

$2.6 billion of it comes from a ‘write-down’ of the value of the aircraft belonging to Qantas’ international fleet – a devaluation intended to reflect their actual worth in today’s market, in the same way that your house might be devalued in a slump.

And this $2.6 billion found its way onto the books only because of Qantas’ decision to effectively spin out its international arm into a new company – a move aimed at attracting foreign investment on the back of recent changes to the Qantas Sale Act.

In short, that $2.6 billion is a paper loss. It doesn’t represent cash. It’s an accounting finesse. It’s a number in a column on an Excel spreadsheet.

The real loss – what’s for obvious reasons called the underlying loss – turns out to be $646 million.

That’s still the biggest loss in Qantas’ modern history since the airline was privatised almost two decades ago.

And while $646 million remains a challenging number, it’s a far cry from $2.8 billion.

Nobody is saying that turning around that $646 million loss, and getting the books to balance, will be easy.

But Qantas is only partway through to run on its ambitious ‘transformation program’ charged with carving out a total $2 billion in savings. There are already signs that this wide-reaching program is paying its first dividends, with Qantas reporting $440 million in ‘transformation benefits’.

The airline has in fact accelerated the scheme, beginning with front-loading the job-losses to shed around 2,200 staff positions by the end of June 2014 – almost half the target of 5,000 jobs to go over the next three financial years.

The first five Boeing 787-9 Dreamliners earmarked for Qantas proved another casualty of a fast-tracked recovery, with purchase options on those fuel-efficient jets being pushed back another year.

The gameplan is that these and other moves, combined with greater efficiencies in using the existing Qantas fleet – and a freeze in the domestic capacity war with Virgin Australia which proved so costly to both airlines – will right the ship.

Joyce has made a brave but measured forecast that Qantas as a group – which includes the now loss-making Jetstar division – will return to an underlying pre-tax profit by the end of this year.

There are ample caveats to this. Hitting cost-saving targets, stable fuel costs, the repeal of the carbon tax and rising demand against stable capacity are all listed on Joyce’s Get Out Of Jail card.

But there are signs that the rising tide of red ink has turned and Qantas is on the way back from the brink.

David Flynn is the Editor of Australian Business Traveller

Follow Australian Business Traveller on Twitter