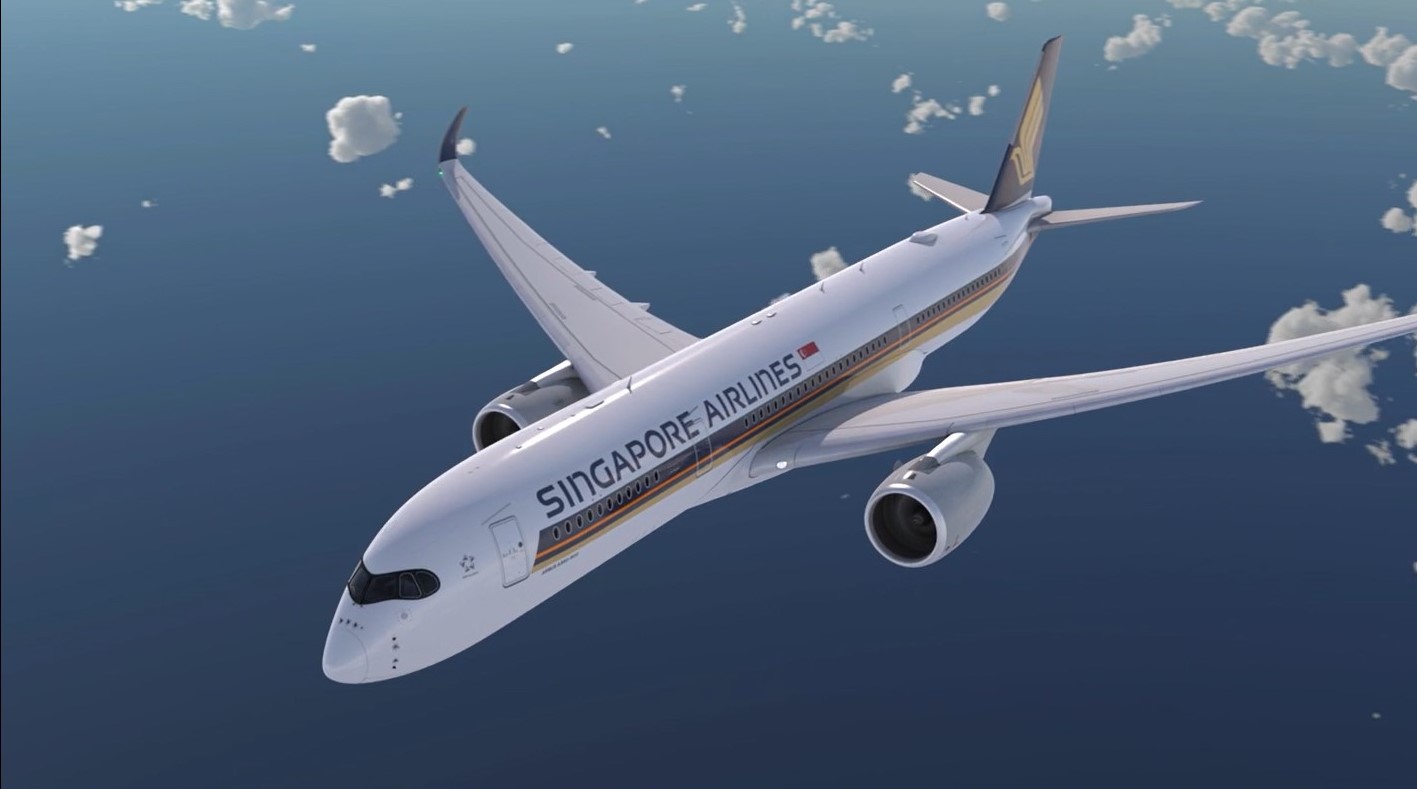

The Singapore Airlines (SIA) Group posted a quarterly profit for the first time

since the onset of the pandemic, recording a third-quarter net profit of S$85 million (US$62.76 million).

This came amid a significant step-up in air travel to and through Singapore in the October-December 2021 period, as well as continued robust demand and strong yields in the cargo market.

The airline credits the turnaround to “Singapore’s launch of Vaccinated Travel Lane (VTL) arrangements and its subsequent expansion, as well as the Group’s response that resulted in it being the first to open sales on almost all available routes, helped unlock pent-up demand during the year-end travel season.”

The Group carried 1.1 million passengers during the quarter, more than five times the number from a year before and double that of the second quarter of FY2021/22.

READ: New weather analysis supports revolutionary WSPRnet MH370 tracking

READ: Qantas reactivates Project Sunrise for ultra-long-range nonstops

READ: Emirates threatens to cancel 777-9s

Passenger capacity (measured in available seat kilometers) grew 183.8 percent year-on-year, as the Group ramped up flights in response to the VTLs.

By the end of the quarter, Group passenger capacity reached 45 percent of pre-Covid-19 levels.

Improvements in passenger and cargo revenue resulted in the Group revenue rising S$1,249 million (+117.1 percent) year-on-year to S$2,316 million. Passenger

revenue increased by S$650 million (+355.2 percent) to S$833 million, on the back of a 556.8 percent growth in traffic (revenue passenger kilometers) that outpaced capacity expansion, resulting in the passenger load factor rising 18.9 percentage points to 33.2 percent.

Cargo revenue rose by S$607 million (+81.6 percent) to S$1,351 million, surpassing the S$1 billion mark for the first time and setting yet another new quarterly record.

Robust demand during the traditional cargo peak period was buoyed by retail inventory restocking and strong e-commerce traffic. Cargo yields rose significantly (+26.9 percent) amid an ongoing industry capacity crunch.

The expansion of operations resulted in Group expenditure growing S$842

million (+60.2 percent) year-on-year to S$2,240 million.

As a result, the Group recorded an operating profit of S$76 million for the

three months ended December 2021, versus a S$331 million loss from a year before

(+$407 million).

The airline added in a statement that “Singapore’s VTL arrangements have been a game-changer for the SIA Group, facilitating quarantine-free mass travel for the first time since the pandemic began.

“While demand should continue to recover, especially on VTL services, passenger traffic is likely to moderate in the fourth quarter after the end of the year-end holiday season.

“The emergence of the Omicron variant in December 2021 resulted in the imposition of additional border restrictions by some governments. However, those measures gradually eased as concerns about the virulence of the variant abated.

“Several key markets have further relaxed testing requirements for incoming passengers, in line with their goal of living with the Covid-19 virus. “

Singapore Airlines expects passenger capacity to reach 51 percent by March which should result in an average capacity of 47 percent for the fourth quarter of FY21/22, compared to pre-Covid levels.

The Group expects to serve over 70 percent of its total pre-Covid destinations by the end of its financial year which concludes on March 31, 2022.