South Korea’s already busy low-cost market will get another player in 2018 when start-up KAIR Airlines begins flying Airbus A320s.

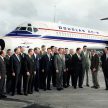

Airbus announced on Monday that the start-up had signed a firm order for eight conventional A320s to operate from its base in Cheongju, in central South Korea. The airline will focus primarily on services to international destinations in North East Asia.

“We see enormous potential for the development of a low-cost model linking central South Korea with destinations in China, Taiwan and Japan”, Byung Ho Kang, KAIR Airlines chairman, said in a statement. “KAIR Airlines will focus on point-to-point services at low fares while offering passengers a modern and fun product offering.”

KAIR Airlines joins a slew of existing low-cost carriers in South Korea, including Eastar Jet, Jeju Air, Jin Air, Air Busan and T’way Airlines. Asiana Airlines Joined the fray last year with low-cost subsidiary Air Seoul, based at Incheon International Airport.

LCC’s enjoy a 22 per cent market share on South Korea’s international routes, up from 16.2 per cent in 2015, and experts predict they are heading quickly towards 30 per cent.

They dominate the domestic market with a combined market share of 56.6 per cent, according to November government statistics reported by the Pulse business news site.

That put them ahead of network carriers Korean Air and Asiana, which between them commanded 43.4 per cent of the market.

Jeju Air, Jin Air, T`way Airlines, Eastar Jet and Air Busan were profitable in 2016 with combined revenues estimated at more than 2.5 trillion won ($US2.08 billion).

Airbus backed the potential of its latest customer with chief operating officer customers John Leahy saying the European manufacturer had been impressed by KAIR’s business model.

“We are confident that the efficiencies offered by the A320 will contribute to a successful launch by KAIR Airlines, bringing more choice for passengers flying in the North East Asian region,’’ he said.