Boeing has faced many challenges in its 100 plus year history that have brought the company to the brink but nothing comes close to the impact of COVID-19.

Last week the US aerospace giant posted a 2nd quarter loss of US$2.39 billion and US$3.03 billion for the 1st half of 2020.

While the company has an operating cash flow of US$5.3 billion, cash and marketable securities of US$32.4 billion and a backlog of $409 billion, including more than 4,500 commercial aircraft the burning question is how many of those will be actually delivered, and when.

In a personal email, Boeing President David Calhoun told workers that the “challenges we face as a company are still unfolding.”

“The reality is the pandemic’s impact on the aviation sector continues to be severe. Though some fliers are returning slowly to the air, their numbers remain far lower than 2019, with airline revenues likewise reduced.”

He told staff that “while there have been some encouraging signs, we estimate it will take around three years to return to 2019 passenger levels.”

Making matters far worse for Boeing is its best-selling 737 MAX is still grounded and probably will not get the tick to fly passengers till October – and that is if they will get on board.

The problem for Boeing is that there is so much negative misinformation about the MAX in social and the wider tabloid media that as the truth slowly emerges about the aircraft and the two crashes it is barely recognizable.

Boeing has almost 400 737 MAXs in storage and recently restarted production and now plans a slower build-up of production than previously planned, with a gradual increase to 31 per month by the beginning of 2022.

That is far cry from two years ago when the production was moving toward almost 60 a month and the company had orders for over 5,000.

Many have now been canceled – mainly because of the downturn in traffic.

Thus, Mr Calhoun has warned workers that “unfortunately, it’s become clear that we need to make further adjustments based on the prolonged impact of COVID-19.”

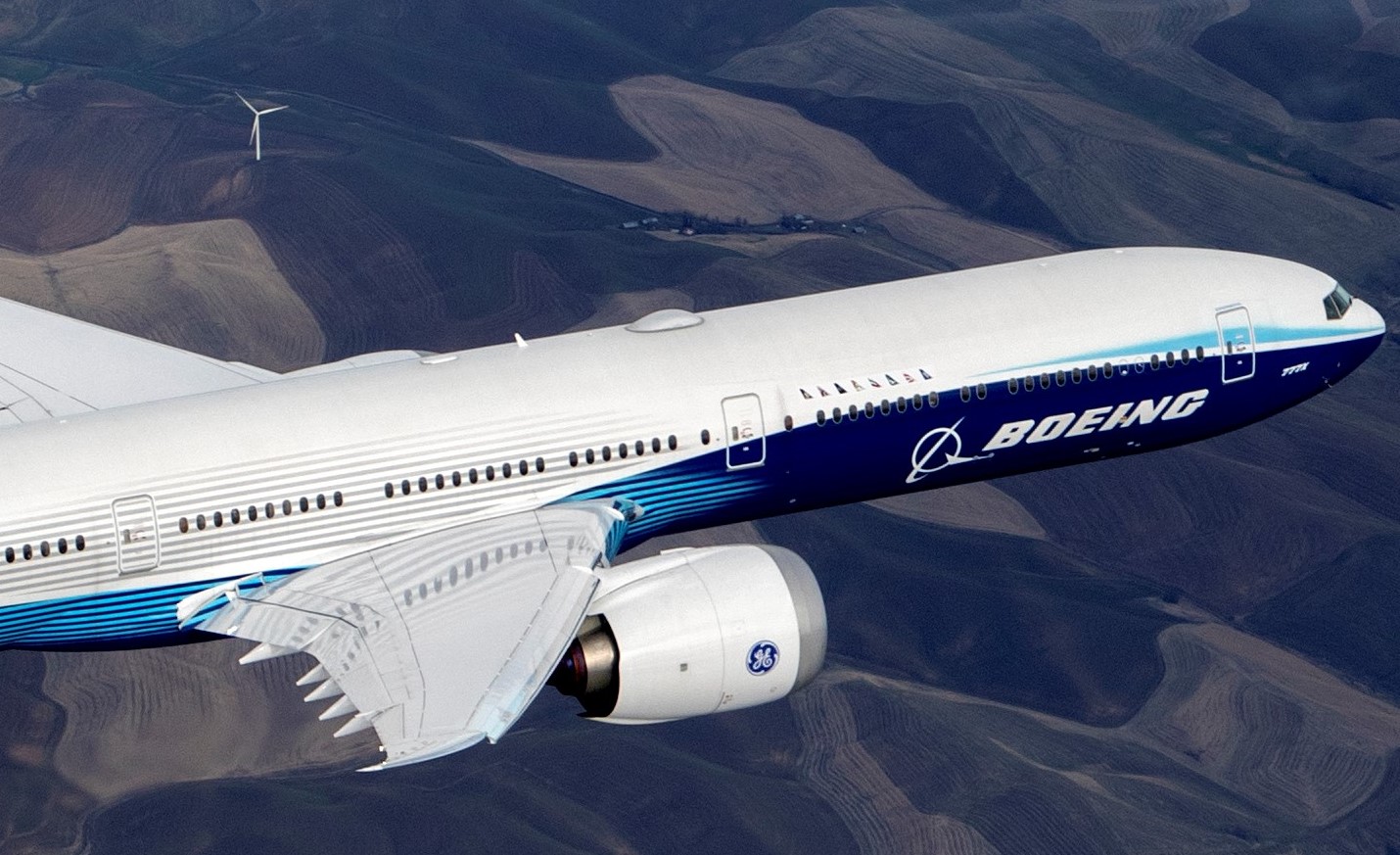

Other production rates will plummet with high yield 787 and 777X models taking a big hit with the 787 dropping to a six month low from a high of 14 and the 777X down to just two a month next year while delaying delivery to airlines to 2022.

And sadly, the iconic 747 production is to end in 2022, while the 767 continues as a freighter and a tanker for the US Air Force.

Boeing has already laid off 10 percent of its workforce and Mr. Calhoun says more layoffs are inevitable.

“Regretfully, the prolonged impact of COVID-19 causing further reductions in our production rates and lower demand for commercial services means we’ll have to further assess the size of our workforce,” he told workers.

On the bright side, the company’s strength in the supply of military fighters such as the F-15 and F-18 and its space business gives it some stability.

The severe downturn means that new designs that Boeing planned to build are now in deep freeze and the aerospace giant may have to enter new collaborative ventures with the Japanese to resurrect them.

One – the 250-seat 797 – was of particular interest to airlines. This design, which Boeing called the New Mid-Size Airplane was to be a twin-aisle design with seating in the economy zone of 2-3-2 and range of around 10 hours.

Airlines were clamoring for Boeing to proceed before COVID-19 and it was expected to be launched this year.