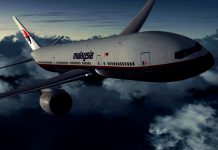

Asia-Pacific carriers still face significant headwinds and potential damage from trade wars after profits more than halved in 2018 to just under $US5 per passenger.

That was the warning from the Association of Asia Pacific Airlines as it released preliminary financial figures that revealed aggregate net earnings fell from $US9.6 billion in 2017 to $US4.7 billion last year.

AAPA director general Andrew Herdman said Asia-Pacific airlines continued to face significant headwinds in the form of persistent cost pressures, stiff competition as well as further volatility in oil and currency markets.

“Whilst air passenger markets remain relatively resilient, the weak sentiment surrounding air cargo markets is a warning signal that trade disputes are doing real damage to the economy and could further undermine global growth prospects going forward,” he said.

“Undaunted, Asia Pacific carriers continue to evolve, adapting to a dynamic market place.

“Airlines are continuously reviewing their business plans, implementing measures to improve efficiency and carefully managing costs whilst seeking opportunities to maximize revenue.

“In addition, the region’s airlines remain at the forefront of industry developments, launching new services and investing continuously in new technologies with the aim of providing passengers with high levels of customer service and a seamless travel experience.”

READ Fall in Aussie airfares as demand softens.

Although continued expansion in the global economy underpinned growth in 2018, AAPA said the region’s carriers had faced an increasingly challenging operating environment marked by higher jet fuel prices, adverse currency movements and rising pressure on non-fuel costs.

“Asian airlines are operating in highly competitive markets, and were not able to pass on the full cost impact of significantly higher fuel prices we saw in 2018,’’ Herdman said.

“Consequently, overall operating margins narrowed to 4.9 percent for the year, from 6.7 percent in 2017.

“After extraordinary items, which included foreign exchange losses for a number of carriers, aggregate net earnings fell to US$4.7 billion in 2018.

“As an indication of the highly competitive nature of the airline business, this represents an average profit level of just under $US5 per passenger flown.”

The drop in 2018 profit for Asia-Pacific carriers came despite robust traffic and revenue growth.

International passenger traffic (measured in revenue passenger kilometres) grew by a healthy 6.9 percent as it was stimulated by further expansion of airline networks and widespread availability of competitive airfares.

Operating and passenger revenues both rose by 10.4 percent, with the former growing to $US204.7 billion and the latter to $US159 billion.

Passenger yields were also up, recording a 3.1 percent rise to 8.1 cents per RPK and cargo revenue rose 11.5 percent to $US21.2 billion.

Offsetting this was a 12.5 percent rise in 2018 operating costs to a combined total of $US194.6 billion.

AAPA said this was driven by a significant 27.5 percent rise in fuel costs, to $US54.5 billion, in tandem with the 29.8 percent jump in global jet fuel prices to an average $US85 per barrel.

Fuel expenditure as a percentage of total operating expenses rose by 3.3 percentage points to 28 percent.

At the same time, non-fuel expenditure increased by 7.6 percent to $US140.1 billion, driven by higher staff costs as well as landing fees and en-route charges.