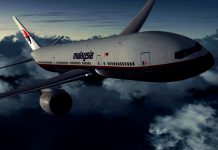

Asia-Pacific airlines experienced a good year for growth in 2018 as the number of international passengers rose 7 percent to more than 356 million.

But the Association of Asia Pacific Airlines has warned 2019 may not be as bountiful.

Read: Airline share prices fell by 20 percent in 2018.

“Whilst expectations of continued moderate growth in the global economy should lend further support to travel markets in the coming months, there are some downside risks including weakness in trade activity and potential erosion in business and consumer sentiment,’’ AAPA director general Andrew Herdman said.

“The region’s airlines are alert to such factors which may affect the market environment, but remain focused on cost management, and investing in future growth opportunities.”

AAPA said continued expansion in the global economy helped support leisure and business travel markets throughout 2018, with broad-based demand in both short- and long-haul markets pushing up revenue passenger kilometres by 6.9 percent.

This was ahead of a 6 percent rise in available seat capacity and saw passenger loads edge up 0.6 percentage points to 80.6 percent for the year.

Growth in cargo was weaker.

International air cargo demand as measured in freight tonne kilometres (FTK) grew by 3.9 percent in 2018, compared to a strong 9.6 percent increase in the previous year.

Freight capacity for the year grew by 6.6 percent, outpacing demand and pushing down the average international freight load factor by 1.6 percentage points to 63.3 percent.

Nonetheless, passenger growth was stronger than the previous year’s increase of 6.4 percent as new routes and frequencies provided more options for travelers.

Herdman said stiff competition meant airfares remained affordable, despite an increase in oil prices.

“Whilst international air cargo demand recorded an encouraging 3.9 percent increase for the full year, growth slowed significantly in the closing months of the year as business confidence in the global manufacturing sector weakened in response to trade policy tensions,” he said.

“Overall, in 2018, the region’s airlines benefitted from robust growth in passenger traffic and further expansion in cargo demand.

“Higher average airfares and record high load factors lifted passenger yields after several years of declines.

“Cargo yields also firmed slightly despite falling load factors.

“ However, cost pressures continued to increase, with higher fuel expenditure driven by a 30 percent increase in jet fuel prices which averaged $US85 per barrel for the year, despite falling back significantly towards the end of the year.”