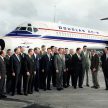

The Airbus, Bombardier tie-up consummated on July 1 has given birth to a rebranded C Series – the A220.

The future of the Bombardier C Series regional jet appears as blue as the skies over Toulouse today when the rebranded A220 aircraft was unveiled in its new livery.

And Airbus and Bombardier are forecasting robust sales for the 100-141 seat A220 series.

David Dufrenois Head of Sales for the C Series said that “we believe that the C Series will be excellent product ahead of the competition.”

“The comfort is outstanding with 18-inch seats and big windows. It is also quietest.”

Importantly the CSeries will be fully integrated into the A320 family.

Eventually, it is hoped that the cockpits of the Bombardier C Series and Airbus A320 types will be fully integrated for cross-crew flying.

And Mr Dufrenois is focused on the US regional market which accounts for 40 percent of the global market. “I have no doubt we will be successful and our global sales force is mobilized.”

Bob Dewar Vice President & General Manager C Series at Bombardier Aerospace said he was super excited about the collaboration and said it puts the program on a solid foundation.

Christine de Gagne CSeries interior, cabin marketing manager said the C Series has been a big hit with passengers.“It has the largest overhead bin space and passengers love the light and airy cabin,” Ms de Gagne said.

The C Series Aircraft Limited Partnership became official closed on July 1.

Airbus is joined in the project by Bombardier which now owns 34 percent, and Investissement Québec, which owns 16 percent.

CSALP’s head office, primary assembly line, and related functions are based in Mirabel, Quebec.

CSALP is claiming that the E190E2 with 100 seats has costs per seat 13% higher than the CS 100 and the E195E2 with 124 seats also has 13% higher costs than the CS 300.

Airbus will provide procurement, sales and marketing and customer support expertise to the venture and sees the 100 to 150 seat C series as “highly complementary” to its single-aisle aircraft in the 150-240-seat range.

The partnership brings two airliners into the Airbus line-up, the CS100 and the bigger CS300, to combine with the European manufacturer’s A319 to compete in the lower end of the single-aisle market.

The C series first flew in 2016 with Swiss International Airlines and the CS100 flies up to 133 passengers in a single-class configuration while the CS300 can handle up to 160.

New York-based analysts Bernstein like the Airbus/Bombardier deal and the Boeing/Embraer deal.

In a client report, it says: “Boeing and Airbus have now each taken steps to move down toward the regional jet market in respective deals with Embraer and Bombardier. We like each deal, but they are very different. Boeing is buying an 80% stake in a profitable going concern at Embraer for $3.8bn. Airbus is buying 50.01% of the C Series from Bombardier for effectively nothing.”

It adds: “Both deals broaden acquirers’ program portfolios and each is intended to leverage scale and strength of sales, support, and supply chain capabilities. But, we see Boeing’s Embraer JV as an acquisition of a profitable program portfolio, plus the capture of significant operational capabilities for engineering, manufacturing, flight test, and component sourcing. In contrast, we see Airbus’ C Series deal as a free option to improve an unprofitable program. The Airbus deal does not appear to provide the same access to capabilities as does the Boeing deal.”

Bernstein says “the C Series deal is possible because the Quebec government saw no other profitability path for the program. Bombardier is responsible for losses over the next 3 years, up to $700m. This means that after 3 years, if the program works, Airbus will continue to sell it. If it stays unprofitable, then it could be shut down. There is no downside risk. Airbus hopes to use its leverage to lower supplier costs and raise sales.”