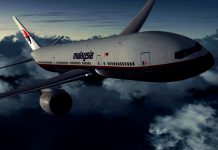

AirAsia X has proposed a group-wide debt and equity restructuring scheme aimed at avoiding liquidation as it warned it was unable to meet its financial obligations.

The long-haul, low-cost airline was hard hit by border closures and said in a stock exchange announcement that it was facing “severe liquidity constraints in meeting its debt and other financial commitments”.

This is despite cost-cutting moves that saw it ground all scheduled flights, cut salaries and retrench staff across the group.

READ: AirAsia bows out of Japan.

With liabilities now exceeding assets by almost 2 billion ringgit ($US480 million) and a deficit in shareholders’ equity, the statement warned an “imminent default” on debt and other financial commitments would see the airline liquidated.

“To avoid a liquidation and to allow the airline to fly again, the only option is for AAX to undertake a group-wide debt and corporate restructuring and update its business model to survive and thrive in the long term,’’ it said.

“The right-sizing of the Group’s level of operations and its financial obligations are pre-requisites for the raising of any fresh capital, comprising both equity and debt, that will be used to support the implementation of the Group’s revised business plan.”

The group appointed chartered accountant, investment banker Lim Kian Onn, who has been on the board since 2012, to lead the restructuring.

The plan includes a scheme to restructure a 63.5 billion ringgit ($US15.3 billion) debt owed to creditors, including passengers who made advance payments for flights.

It proposes converting advance payments and deposits for tickets into travel credits for “future travel or purchase of seat inventory”.

The airline also plans to rationalize its network by terminating or suspending unprofitable or immature routes and shifting its focus from market share to sustainability, profitability and yield.

The company said it had been involved in extensive discussions with major creditors over the past two months.

While there was varying degrees of support for the proposed restructuring scheme, it said there was strong support for the continuation of the airline business.

“AirAsia X and other airlines the world over are struggling to survive amidst the global crisis of COVID-19 pandemic,’’ chief executive Benyamin Ismail said.

“We remain committed to our guests, Allstars, business partners and shareholders to ensure we build a viable and sustainable airline for the long-haul, and for the survival of this airline, the proposed restructuring plan is our only option.

“It has been extremely difficult for the airline during this period as we had to ground all scheduled flights, implement salary cuts and retrenchment for the first time in the company’s history as a consequence of the pandemic.

“Similar exercises are likely to continue during the restructuring process, but our focus is to ensure a successful restructuring to keep as many jobs as possible.”

“We have a low cost base, we are in the right part of the market and many of our key markets are in green zones which are likely to reopen first.

“We have a robust recovery strategy in place, and with the continued support from our stakeholders, we will overcome all challenges and come out stronger.”

AirAsia X had established a strong foothold in markets such as China, Japan, Korea and Australia.

Ismail said the airline still had “ongoing dialogue with tourism and airport authorities, governments and other industry stakeholders to pave the way for the prospect of travel bubbles in green zone countries”.