A big LED-lit sign on the roof proclaims “Home of Air Baltic”, and the interior of the headquarters of one of Europe’s most innovative airlines looks a bit like a start-up.

In Air baltic CEO Martin Gauss, who has led the flag carrier of Latvia for the past seven years, Bombardier and now Airbus have their biggest ally and product ambassador for what was the CSeries and now is branded the Airbus A220.

There has been no recent air show anywhere, be it in Dubai, Singapore or Farnborough, or major aviation gatherings like the IATA AGM or CAPA conferences in Sydney in June or the Aviation Festival in London in September where Gauss wouldn’t have been present to create awareness both for the aircraft and his airline in front of a global audience.

Gauss, now 50, became a Euro multi-millionaire in his 30s when he sold his stake of 10% in former Deutsche BA to Air Berlin. He has always been one of the most avid supporters of what is currently the most modern airliner.

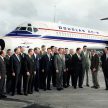

Gauss excels at air shows leading industry visitors through the A220-300 of which Air Baltic currently operates 11 out of an order of 50 firm plus 30 options.

In his office in Riga, he has set up an impressive display – 80 tiny A220 aircraft models in 1:500 scale, exactly the number his airline wants to operate by 2025.

Even counting only current firm orders Air Baltic ranks second worldwide after US giant Delta Air Lines (receiving its first in late 2019) in the number of A220 commitments.

In May 2018, shortly before it was re-branded as A220, Air Baltic placed a huge order for 60 further aircraft, on top of 20 already in the books, 30 firm and 30 options.

Counting list prices puts the firm order has a value of about US$3bn, the biggest investment overall in the history of Latvia, a former Soviet rep[ublic which became independent in 1991 and is an EU member state.

Gauss, who still holds a Boeing 737 pilot license and started as a first officer at Deutsche BA, got hooked on the CSeries early.

READ: Airbus, Bombardier tie-up adds A220 to impressive portfolio.

In 2012, when the industry was skeptical if the concept would ever take off, he ordered ten CS300s for Air Baltic, reportedly at rock-bottom prices.

He faced harsh criticism both from his native Germany and from France for not buying Airbus aircraft.

“I got into great trouble, even German politicians came to Riga to tell the government it was unacceptable that a Latvian state carrier buys Canadian aircraft in bulk,” he says.

But Gauss has stuck by his belief, observing: “This aircraft is a big success because there is nothing better in the 150-seater market and there won’t be at least for the next decade.”

Over 1.5 million of his passengers have flown the A220 so far and customer feedback is hugely positive compared to what it used to be. Air Baltic still also operates eleven older Boeing 737s and twelve Q400 turboprops, which all will be phased out by 2022 to be replaced with a pure A220 fleet.

But why is he as an airline CEO investing so much time and effort to promote an aircraft type?

“We want to do sale and leaseback deals with a part of our fleet and for that, the aircraft must be well known, well liked and have a strong market presence,” Gauss says.

So far 41 A220s have been delivered to Swiss, the launch operator, Air Baltic and Korean Air. The current order book stands at a mere 402 but Airbus believes it could sell about 3,000 A220s in the coming years, thanks to its much more efficient supplier network and more effective sales force.

Gauss is not officially part of this but believes his efforts have already started to pay off for his airline’s brand, the awareness of the aircraft and its market value.

“The switch from Bombardier to Airbus can be felt already in the level of acceptance on the leasing market, as part of the Airbus portfolio the aircraft now has an acceptance there that wasn’t existing before,’’ he notes.

“One can assume that there will be more orders in the future, and that would help us as the launch operator of the A220-300 as it would make our aircraft more valuable, the more are built the more value they have.”

Air Baltic, which introduced the first of the then CS300 in December 2016, has been in an upward mode for recent years after a near-bankruptcy early in the decade. It has been profitable since 2013 and 2018 is expected to become another record year, which will see passenger numbers climb to 4 million.

While mainly operating to about 70 destinations from Riga all over Europe Air Baltic started to serve more far-flung cities recently.

There is a seasonal route from Riga to Abu Dhabi, taking over six hours flight time westbound on the A220, and recently a new route to Almaty in Kazakhstan, almost as far from Riga.

“It’s our strategy to enable passengers to get to Riga from anywhere in the world with just one stop”, explains Gauss, “not so much to raise the number of passengers but to ensure connectivity for the Baltic states.”

There are three Baltic states, including Lithuania and Estonia, with a total population of six million people.

In order to raise extra capital for its expansion plans Air Baltic is currently searching for a strategic investor.

Both the Latvian state, currently holding 80 percent of the airline, as well as a private Danish investor, a leasing company holding 20%, would be willing to sell shares.

One of the participating banks has already praised Air Baltic’s “world-class management”.