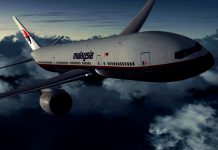

Boeing and Airbus are still great investments despite market issues say one of the world’s leading aviation analysts.

New York-based Bernstein in a new report, “Airbus, Boeing: How scary? Slowing traffic growth, no orders, MAX/NEO issues – Why the investment case still works” says it remains positive on both Airbus and Boeing, as well as on Safran and Spirit Aerosystems.

The main market issues are passenger traffic for July of 3.6% which was below normal long-term RPK growth rate of 5%, giving a 4.7% YTD growth rate.

READ: European regulator demand will not stop 737MAX re-entry to service.

Bernstein notes that “capacity is affected, in part, by the grounding of the 737MAX and A321 delivery delays. We estimate roughly 600 MAX airplanes should have been available and were not (either parked by airlines or stored by Boeing), which also supports record load factors of 85.7%.”

In the report, Bernstein notes that “August orders remained weak. 2019 continues to be the worst year for Boeing and Airbus orders in the last decade – and that would be true even if one adds all MOUs from the Paris Air Show. We see low orders as from economic uncertainty, large backlogs, and delivery issues on popular models.”

However, the “good news is that Boeing and Airbus still have more than 7 years of production each in backlog. As long as airlines are profitable, we see little risk to deliveries. Airline profitability remained good in Q2 at the vast majority of airlines and fuel costs are not increasing. When airlines are profitable, they rarely cancel or defer deliveries,” says Bernstein.

But Bernstein notes Boeing’s CEO, Dennis Muilenburg’s, comments that said that “there is some risk to 14/month rates on the 787, particularly if US-China trade discussions do not improve.”

Bernstein says, however, the “787 appears solid to us at 14/month through 2021. Orders are needed for 2022-23, for which there still should be time on a popular model. More orders are also needed for the A330neo and 777X in that time frame. China trade issues remain important for all Boeing orders.”

The 777X entry into service in 2020 has risk, due to the need to resolve GE9X engine issues warns Bernstein. Neither company sees issues with narrow body demand and the A350 appears solid.